Multiple Choice

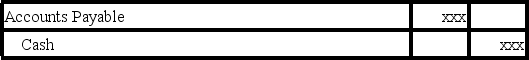

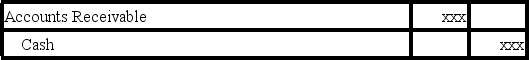

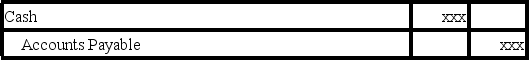

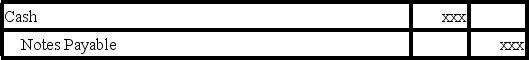

Which of the following journal entries is correct when a business entity uses cash to pay an account payable?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q99: For each of the accounts listed below,indicate

Q100: The continuity assumption states that a business

Q101: A transaction may be an exchange of

Q102: Why is the continuity assumption so important

Q103: Where would changes in stockholders' equity resulting

Q105: Which of the following would result when

Q106: A company's assets and stockholders' equity both

Q107: Which of the following statements is <b>incorrect</b>

Q108: Cadet Company paid an accounts payable of

Q109: Unearned revenue is reported on the balance