Essay

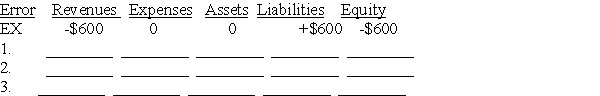

Given the table below,indicate the impact of the following errors made during the adjusting entry process.Use a "+" followed by the amount for overstatements,a "-" followed by the amount for understatements,and a "0" for no effect.The first one is done as an example.

Ex.Failed to recognize that $600 of unearned revenues,previously recorded as liabilities,had been earned by year-end.

1.Failed to accrue interest expense of $200.

2.Forgot to record $7,700 of depreciation on machinery.

3.Failed to accrue $1,300 of revenue earned but not collected.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Flagg records adjusting entries at its December

Q68: Discuss how accrual accounting enhances the usefulness

Q69: The aim of a post-closing trial balance

Q135: Adjustments must be entered in the journal

Q140: Temporary accounts include all of the following

Q168: Current assets and current liabilities are expected

Q170: A balance sheet that places the assets

Q173: Harrod Company paid $4,800 for a 4-month

Q182: High Step Shoes had annual revenues of

Q374: Financial statements are typically prepared in the