Essay

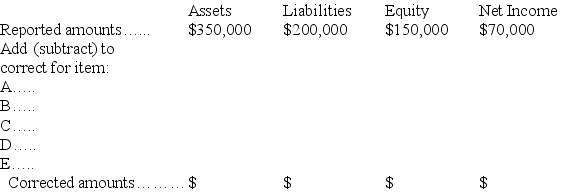

A company issued financial statements for the year ended December 31,but failed to include the following adjusting entries:

A.Accrued interest revenue earned of $1,200.

B.Depreciation expense of $4,000.

C.Portion of prepaid insurance expired (an asset)used $1,100.

D.Accrued taxes of $3,200.

E.Revenues of $5,200,originally recorded as unearned,have been earned by the end of the year.

Determine the correct amounts for the December 31 financial statements by completing the following table:

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Explain why temporary accounts are closed each

Q48: A company purchased new furniture at a

Q80: On December 14, Branch Company received $3,000

Q91: In accrual accounting, accrued revenues are recorded

Q104: Cash and office supplies are both classified

Q104: The closing process is necessary in order

Q105: Flo's Flowers' current ratio is 1.3. The

Q183: Revenue accounts are temporary accounts that should

Q206: Depreciation expense for a period is the

Q314: If accrued salaries were recorded on December