Essay

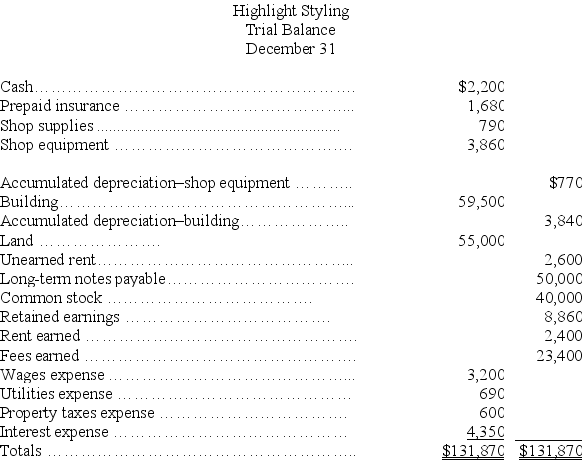

Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

Highlight Stylings' for the current year follows:

Additional information:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Current liabilities include accounts receivable, unearned revenues,

Q68: The Unadjusted Trial Balance columns of a

Q72: Adjusting entries result in a better matching

Q101: The trial balance prepared after all closing

Q104: The closing process is necessary in order

Q105: Flo's Flowers' current ratio is 1.3. The

Q143: List and explain the steps in preparing

Q228: A company paid $9,000 for a twelve-month

Q241: A company's December 31 work sheet for

Q307: The Retained earnings account has a credit