Multiple Choice

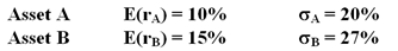

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%:  An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

A) only Asset A is acceptable

B) only Asset B is acceptable

C) neither Asset A nor Asset B is acceptable

D) both Asset A and Asset B are acceptable

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The holding period return on a share

Q13: Published data on past returns earned by

Q14: You invest $10 000 in a complete

Q16: The complete portfolio refers to the investment

Q26: The reward/variability ratio is given by _.<br>A)

Q29: You have an APR of 7.5% with

Q37: In the mean-standard deviation graph,the line that

Q53: The Manhawkin Fund has an expected return

Q62: The _ measure of returns ignores compounding.<br>A)

Q70: If you require a real growth in