Multiple Choice

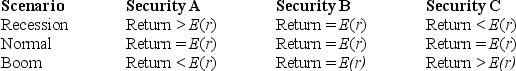

Based on the outcomes in the following table, choose which of the statements below is (are) correct?

I. The covariance of security A and security B is zero.

II. The correlation coefficient between securities A and C is negative.

III. The correlation coefficient between securities B and C is positive.

A) I only

B) I and II only

C) II and III only

D) I, II, and III

Correct Answer:

Verified

Correct Answer:

Verified

Q43: The expected return of a portfolio is

Q44: You run a regression for a stock's

Q45: A project has a 50% chance of

Q46: You run a regression for a stock's

Q47: The part of a stock's return that

Q49: Investing in two assets with a correlation

Q50: To construct a riskless portfolio using two

Q51: The portfolio with the lowest standard deviation

Q52: Approximately how many securities does it take

Q53: The optimal risky portfolio can be identified