Multiple Choice

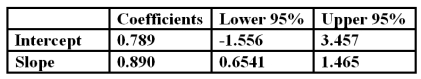

You run a regression of a stock's returns versus a market index and find the following:  Based on the data you know that the stock

Based on the data you know that the stock

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to 0.890

C) has a beta that could be anything between 0.6541 and 1.465 inclusive

D) has no systematic risk

Correct Answer:

Verified

Correct Answer:

Verified

Q3: If all investors become more risk averse,

Q19: Empirical results estimated from historical data indicate

Q20: What is the expected return on the

Q22: Consider the single factor APT.Portfolio A has

Q23: You invest $600 in security A with

Q27: The beta of a security is equal

Q29: Assume that both X and Y are

Q31: The most significant conceptual difference between the

Q53: According to the CAPM, which of the

Q70: Arbitrage is based on the idea that