Multiple Choice

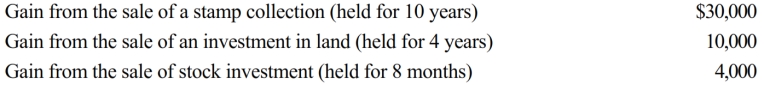

Perry is in the 32% tax bracket. During 2018, he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

A) (15% × $30,000) + (32% × $4,000) .

B) (15% × $10,000) + (28% × $30,000) + (32% × $4,000) .

C) (0% × $10,000) + (28% × $30,000) + (32% × $4,000) .

D) (15% × $40,000) + (32% × $4,000) .

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The basic and additional standard deductions both

Q69: Match the statements that relate to each

Q75: Match the statements that relate to each

Q122: Adjusted gross income (AGI) sets the ceiling

Q129: Matching <br>Regarding classification as a dependent, classify

Q132: Regarding the tax formula and its relationship

Q136: Kohsei had the following transactions for 2018:<br>

Q137: Helen, age 74 and a widow, is

Q138: In terms of timing as to any

Q158: In order to claim someone other than