Multiple Choice

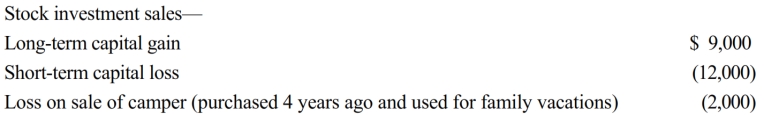

For the current year, David has wages of $80,000 and the following property transactions:

What is David's AGI for the current year?

A) $76,000.

B) $77,000.

C) $78,000.

D) $89,000.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Match the statements that relate to each

Q14: In 2018, Ed is 66 and single.

Q15: Regarding head of household filing status, comment

Q16: In terms of income tax consequences, abandoned

Q17: Jason and Peg are married and file

Q32: In meeting the criteria of a qualifying

Q53: Match the statements that relate to each

Q74: Matching <br>Regarding classification as a dependent, classify

Q81: In resolving qualified child status for dependency

Q117: List at least three exceptions to the