Essay

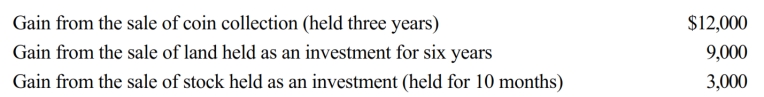

During 2018, Jackson had the following capital gains and losses:

a. How much is Jackson's tax liability if he is in the 12% tax bracket?

b. If his tax bracket is 32% (not 12%)?

Correct Answer:

Verified

a. $1,800. Gain of $12,000 on the sale o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a. $1,800. Gain of $12,000 on the sale o...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q25: Sarah furnishes more than 50% of the

Q26: After her divorce, Hope continues to support

Q27: Claude's deductions from AGI exceed the standard

Q72: When the kiddie tax applies, the child

Q73: Which, if any, of the following statements

Q75: Tony, age 15, is claimed as a

Q77: Clara, age 68, claims head of household

Q79: Jayden and Chloe Harper are husband and

Q80: Roy and Linda were divorced in 2017.

Q121: Surviving spouse filing status begins in the