Multiple Choice

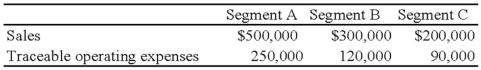

Trevor Company discloses supplementary operating segment information for its three reportable segments. Data for 20X8 are available as follows:  Additional 20X8 expenses include indirect operating expenses of $200,000. Appropriately selected common indirect operating expenses are allocated to segments based on the ratio of each segment's sales to total sales. The 20X8 operating profit for Segment B was:

Additional 20X8 expenses include indirect operating expenses of $200,000. Appropriately selected common indirect operating expenses are allocated to segments based on the ratio of each segment's sales to total sales. The 20X8 operating profit for Segment B was:

A) $180,000

B) $120,000

C) $150,000

D) $250,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: How would a company report a change

Q19: Note: This is a Kaplan CPA Review

Q20: Forge Company, a calendar-year entity, had 6,000

Q22: An analysis of Abbey Company's operating segments

Q24: Note: This is a Kaplan CPA Review

Q26: Wakefield Company uses a perpetual inventory system.

Q28: Note: This is a Kaplan CPA Review

Q30: Davis Company uses LIFO for all of

Q41: ASC 280 requires certain disclosures about major

Q49: Samuel Corporation foresees a downturn in its