Multiple Choice

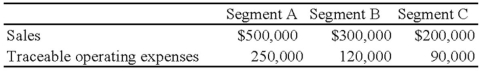

Trevor Company discloses supplementary operating segment information for its three reportable segments. Data for 20X8 are available as follows:  Allocable costs for the year was $180,000. Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs. The 20X8 operating profit for Segment B was:

Allocable costs for the year was $180,000. Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs. The 20X8 operating profit for Segment B was:

A) $110,000

B) $180,000

C) $126,000

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In 20X6 and 20X7,each of Putney Company's

Q5: Note: This is a Kaplan CPA Review

Q8: Stone Company reported $100,000,000 of revenues on

Q9: Toledo Imports, a calendar-year corporation, had the

Q11: On March 15,20X9,Clarion Company paid property taxes

Q12: If a company changes the method it

Q15: An analysis of Abbey Company's operating segments

Q34: ASC 270 uses which view of interim

Q44: On June 30,20X8,String Corporation incurred a $220,000

Q47: The income tax expense applicable to the