Multiple Choice

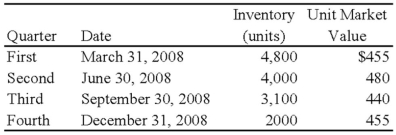

Forge Company, a calendar-year entity, had 6,000 units in its beginning inventory for 20X8. On December 31, 20X7, the units had been adjusted down to $470 per unit from an actual cost of $510 per unit. It was the lower of cost or market. No additional units were purchased during 20X8. The following additional information is provided for 20X8:  Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information, the cost of goods sold for the year 20X8, is:

A) $2,080,000

B) $1,880,000

C) $1,835,000

D) $1,910,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Frahm Company incurred a first quarter operating

Q13: Zeus Corporation has determined that it has

Q15: The management approach to the definition of

Q29: Which of the following observations is true

Q42: All of the following situations require a

Q53: Estimated gross profit rates may be used

Q54: Wakefield Company uses a perpetual inventory system.

Q56: Ridge Company is in the process of

Q57: Wakefield Company uses a perpetual inventory system.

Q58: Collins Company reported consolidated revenue of $120,000,000