Multiple Choice

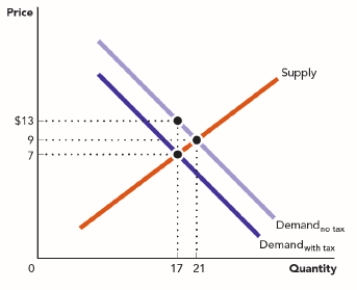

Use the figure A Tax on the Demand for a Good II. A $6 excise tax has been placed on this market. How much of this $6 tax does the seller pay?

Figure: A Tax on the Demand for a Good II

A) $4

B) $6

C) $2

D) $10

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q45: The sign of a cross-price elasticity indicates

Q46: The price elasticity of supply depends on:<br>A)

Q47: Luxuries are goods with income elasticities that

Q48: Perfectly elastic demand curves are:<br>A) vertical.<br>B) horizontal.<br>C)

Q49: An increase in the price of one

Q51: The government of Maxistan places a tax

Q52: Does a good that has a perfectly

Q53: Your friend has a food truck and

Q54: Use the table The Price Elasticity of

Q55: A 1 percent increase in the price