Multiple Choice

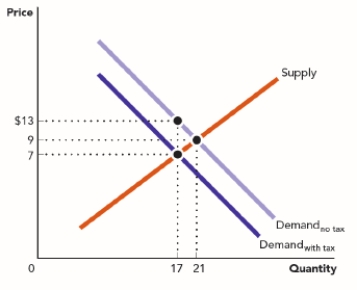

Use the figure A Tax on the Demand for a Good II. A $6 excise tax has been placed on this market. What can be concluded based on tax incidence in this market?

Figure: A Tax on the Demand for a Good II

A) The price elasticity of demand is smaller than the price elasticity of supply.

B) The price elasticity of demand is larger than the price elasticity of supply.

C) The price elasticity of supply is equal to the price elasticity of demand.

D) The entire burden of the tax falls on the buyers of this good.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Ray is one of many sellers of

Q2: If Ana's income elasticity of demand for

Q3: Suppose that a 20 percent increase in

Q4: If an economist wants to know if

Q6: When Otto's income increases, he buys fewer

Q7: Use the figure A Tax on the

Q8: List the factors that determine whether a

Q9: If consumers' response to a price change

Q10: The percentage change in quantity supplied in

Q11: An economist has determined that the income