Multiple Choice

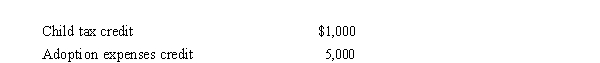

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000.and his tentative minimum tax is $195,000.Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A) $190,000

B) $194,000

C) $195,000

D) $200,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In the current tax year David, a

Q28: Which of the following best describes the

Q47: In working with the foreign tax credit,

Q56: Kay claimed percentage depletion of $119,000 for

Q61: Green Company, in the renovation of its

Q64: Marvin, the vice president of Lavender, Inc.,

Q77: Do AMT adjustments and AMT preferences increase

Q81: Elmer exercises an incentive stock option (ISO)

Q96: The components of the general business credit

Q100: If the cost of a building constructed