Essay

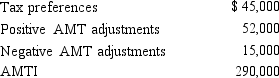

Use the following selected data to calculate Devon's taxable income.Devon itemizes deductions.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Paul incurred circulation expenditures of $180,000 in

Q8: The net capital gain included in an

Q19: The tax benefits resulting from tax credits

Q30: A taxpayer has a passive activity loss

Q40: A taxpayer who expenses circulation expenditures in

Q44: The incremental research activities credit is 20%

Q45: What is the purpose of the AMT

Q50: Discuss the treatment of unused general business

Q82: Prior to the effect of tax credits,

Q83: Tamara operates a natural gas sole proprietorship