Essay

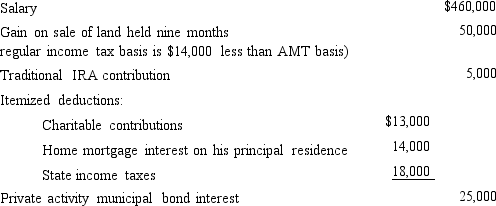

Gunter, who is divorced, provides you with the following financial information for the current year.Calculate Gunter's AMTI.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: In 2018, the amount of the deduction

Q25: Celia and Christian, who are married filing

Q26: Nell records a personal casualty loss deduction

Q32: Evan is a contractor who constructs both

Q35: If Abby's alternative minimum taxable income exceeds

Q36: The tax credit for rehabilitation expenditures for

Q48: When qualified residence interest exceeds qualified housing

Q59: In deciding whether to enact the alternative

Q79: Business tax credits reduce the AMT and

Q106: Roger is considering making a $6,000 investment