Essay

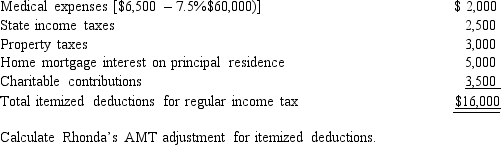

In calculating her taxable income, Rhonda, who is age 45, claims the following itemized deductions.

Correct Answer:

Verified

Rhonda's allowed itemized dedu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Rhonda's allowed itemized dedu...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q14: The required adjustment for AMT purposes for

Q16: AGI is used as the base for

Q19: How can interest on a private activity

Q21: The standard deduction is allowed for regular

Q33: Which of the following would not cause

Q36: Amber is in the process this year

Q78: How can the positive AMT adjustment for

Q90: Which, if any, of the following correctly

Q114: A U.S. taxpayer may take a current

Q118: Molly has generated general business credits over