Multiple Choice

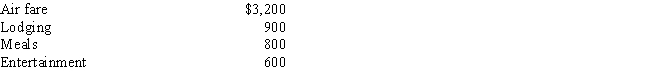

During the year, John went from Milwaukee to Alaska on business. Preceding a five-day business meeting, he spent four days vacationing at the beach. Excluding the vacation costs, his expenses for the trip are:  Presuming no reimbursement, deductible expenses are:

Presuming no reimbursement, deductible expenses are:

A) $3,200.

B) $3,900.

C) $4,800.

D) $5,500.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Employees who render an adequate accounting to

Q12: Match the statements that relate to each

Q16: In November 2017, Katie incurs unreimbursed moving

Q17: Match the statements that relate to each

Q19: Match the statements that relate to each

Q73: Jake performs services for Maude.If Maude provides

Q79: Sue performs services for Lynn. Regarding this

Q105: Sue performs services for Lynn. Regarding this

Q128: Which, if any, of the following factors

Q144: Sue performs services for Lynn. Regarding this