Multiple Choice

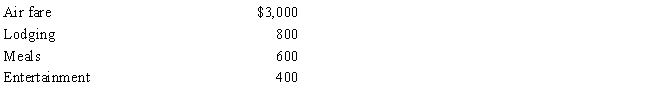

During the year, Sophie went from Omaha to Lima (Peru) on business. She spent four days on business, two days on travel, and four days on vacation. Disregarding the vacation costs, Sophie's unreimbursed expenses are:  Sophie's deductible expenses are:

Sophie's deductible expenses are:

A) $4,300.

B) $3,100.

C) $2,800.

D) $2,500.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Regarding tax favored retirement plans for employees

Q17: A taxpayer who maintains an office in

Q46: Once the actual cost method is used,

Q59: Arnold is employed as an assistant manager

Q60: Which, if any, of the following expenses

Q63: Frank, a recently retired FBI agent, pays

Q67: Paul is employed as an auditor by

Q68: Match the statements that relate to each

Q77: Ashley and Matthew are husband and wife

Q137: Sue performs services for Lynn. Regarding this