Multiple Choice

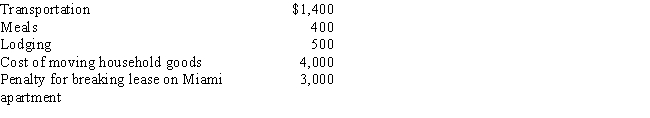

Due to a merger, Allison transfers from Miami to Chicago. Under a new job description, she is reclassified from employee to independent contractor status. Her moving expenses, which are not reimbursed, are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: In November 2017, Katie incurs unreimbursed moving

Q17: Match the statements that relate to each

Q19: Match the statements that relate to each

Q22: After she finishes working at her main

Q23: Statutory employees:<br>A)Report their expenses on Form 2106.<br>B)Include

Q24: During 2017, Eva used her car as

Q25: In May 2017, after 11 months on

Q42: Logan, Caden, and Olivia are three unrelated

Q79: Sue performs services for Lynn. Regarding this

Q128: Which, if any, of the following factors