Essay

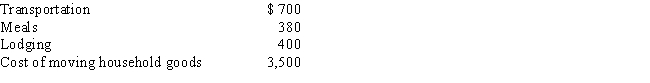

After graduating from college, Clint obtained employment in Omaha. In moving from his parents' home in Baltimore to Omaha, Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Under the right circumstances, a taxpayer's meals

Q27: Which, if any, of the following is

Q37: Madison and Christopher are staff accountants at

Q44: Match the statements that relate to each

Q47: Corey is the city sales manager for

Q49: Match the statements that relate to each

Q72: Amy lives and works in St.Louis.In the

Q89: For tax purposes, travel is a broader

Q106: Myra's classification of those who work for

Q138: When using the automatic mileage method, which,