Essay

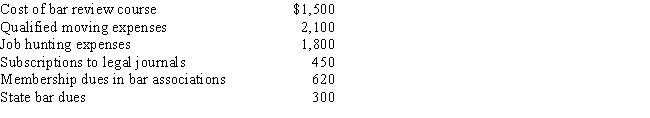

In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school. Her expenses for the year are listed below:

Since Bo worked just part of the year, her salary was only $32,100. In terms of deductions from AGI, how much does Bo have?

Since Bo worked just part of the year, her salary was only $32,100. In terms of deductions from AGI, how much does Bo have?

Correct Answer:

Verified

$770. AGI is $30,000 [$32,100 (salary) -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Isabella is a dental hygienist who works

Q55: A statutory employee is not a common

Q63: In which, if any, of the following

Q83: A taxpayer who uses the automatic mileage

Q85: The Federal per diem rates that can

Q87: Under the simplified method, the maximum office

Q124: Jackson gives his supervisor and her husband

Q134: Christopher just purchased an automobile for $40,000

Q156: One indicia of independent contractor (rather than

Q158: At age 65, Camilla retires from her