Essay

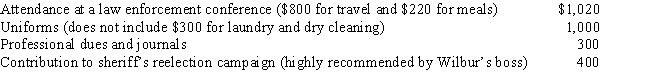

For the current year, Wilbur is employed as a deputy sheriff of a county. He has AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

$1,510. $910 + $1,300 + $300 = $2,510 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: For tax purposes, a statutory employee is

Q63: In which, if any, of the following

Q85: The Federal per diem rates that can

Q86: If a business retains someone to provide

Q101: The § 222 deduction for tuition and

Q141: Match the statements that relate to each

Q144: Travis holds rights to a skybox (containing

Q145: Discuss the 2%-of-AGI floor and the 50%

Q147: Concerning the deduction for moving expenses, what

Q149: Which, if any, of the following is