Multiple Choice

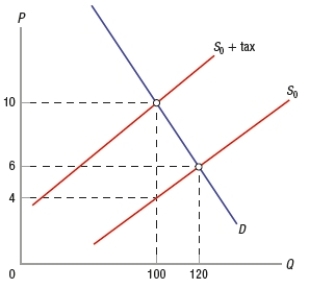

(Figure: Impact of Tax on Market Equilibrium) Based on the graph, implementing a tax

A) lowers equilibrium price from $6 to $4 and lowers equilibrium quantity from 120 to 100 units.

B) lowers equilibrium price from $10 to $6 and lowers equilibrium quantity from 120 to 100 units.

C) raises equilibrium price from $6 to $10 and lowers equilibrium quantity from 120 to 100 units.

D) raises equilibrium price from $6 to $10 and raises equilibrium quantity from 100 to 120 units.

Correct Answer:

Verified

Correct Answer:

Verified

Q238: How is price elasticity of supply computed

Q239: Which would characterize the response in equilibrium

Q240: Suppose that the quantity demanded of a

Q241: When moving down along a linear demand

Q242: The short run is always considered to

Q244: In the short run, firms<br>A) exhibit a

Q245: Which of these would you expect to

Q246: A progressive tax is a tax that<br>A)

Q247: Based on sales history, a retailer calculates

Q248: (Table) According to the table, what