Multiple Choice

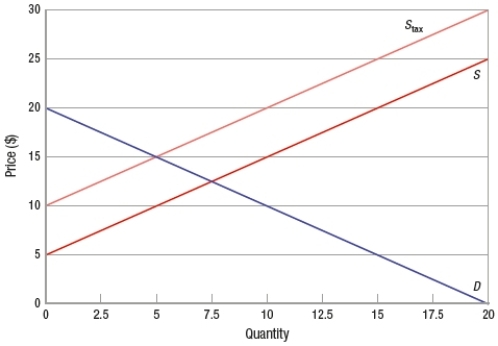

(Figure) The figure shows a market with a supply tax with quantity measured in thousands. The dead weight loss due to the tax is _____ and the tax incidence is _____.

A) $6,250; borne evenly

B) $12,500; borne more heavily by producers

C) $3,125; borne more heavily by consumers

D) $18,750; zero

Correct Answer:

Verified

Correct Answer:

Verified

Q273: Which of these is considered a primary

Q274: The price elasticity of supply is the

Q275: An inelastic demand curve will have an

Q276: In general, tax incidence falls more on

Q277: The price elasticity of supply measures the

Q279: The day after Halloween, grocery stores discount

Q280: Elasticity is a measure of the responsiveness

Q281: As the price of bananas fell from

Q282: If the price of downloaded music falls

Q283: The greater the percentage of the budget