Multiple Choice

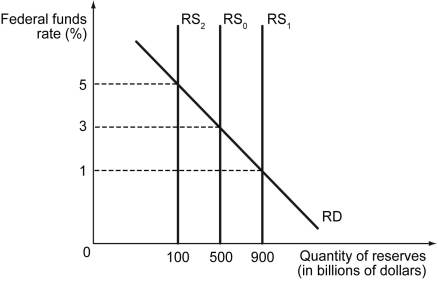

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

-Refer to the scenario above.If the Fed completes an open market sale of bonds that changes the quantity of reserves by $400 billion,then the federal funds rate will ________.

A) increase to 5 percent

B) decrease to 1 percent

C) remain at 3 percent

D) more information is needed to determine the new federal funds rate

Correct Answer:

Verified

Correct Answer:

Verified

Q142: Which of the following is true of

Q143: If consumers save the entire amount of

Q144: If the nominal interest rate falls,everything else

Q145: If the value of a government taxation

Q146: To _ the long-term real interest rate,the

Q148: Scenario: The following figure shows the federal

Q149: Explain the goal of a countercyclical fiscal

Q150: Which of the following is likely to

Q151: How did households use the tax rebates

Q152: If the expansionary effect of additional government