Multiple Choice

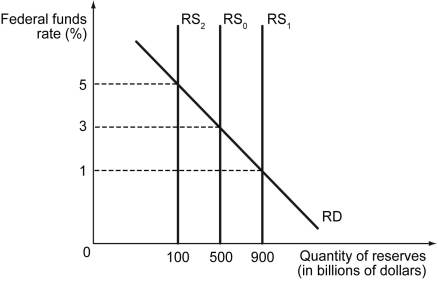

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

-Refer to the scenario above.Suppose the Fed wants to lower the federal funds rate by 2 percent.To do this,the Fed will have to ________.

A) sell $400 billion worth of bonds to a private bank

B) sell less than $400 billion worth of bonds to a private bank

C) buy $400 billion worth of bonds from a private bank

D) buy less than $400 billion worth of bonds from a private bank

Correct Answer:

Verified

Correct Answer:

Verified

Q28: A countercyclical fiscal policy is conducted by

Q29: If the federal funds rate is set

Q30: If a $15 billion reduction in taxation

Q31: Scenario: The following table shows the initial

Q32: If reserves held at the Fed by

Q34: Which of the following is an example

Q35: A countercyclical fiscal policy is conducted by

Q36: Suppose the inflation rate target is zero

Q37: What is the disadvantage of using an

Q38: Government funding of socially valuable projects always