Multiple Choice

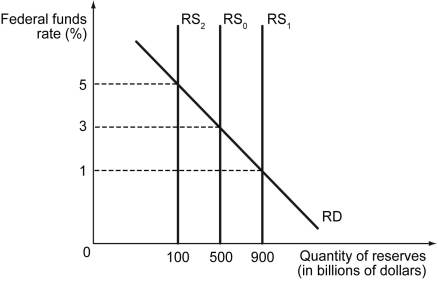

Scenario: The following figure shows the federal funds market. Assume that the market of reserves is in equilibrium at $500 billion in reserves and a 3 percent federal funds rate.

-Refer to the scenario above.Suppose the Fed wants to raise the federal funds rate by 2 percent.To do this,the Fed will have to ________.

A) sell $400 billion worth of bonds to a private bank

B) sell less than $400 billion worth of bonds to a private bank

C) buy $400 billion worth of bonds from a private bank

D) buy less than $400 billion worth of bonds from a private bank

Correct Answer:

Verified

Correct Answer:

Verified

Q6: If the Fed is able to maintain

Q7: What do countercyclical fiscal and monetary policies

Q8: Scenario: The following figure shows the federal

Q9: Countercyclical policies can be _ and _.<br>A)

Q10: The quantity theory of money implies that

Q12: Suppose the inflation rate target is zero

Q13: The primary tool of monetary policy is

Q14: A _ in long-term interest rates _

Q15: Why would policymakers target a reduction in

Q16: The aggregate price level is likely to