Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Essay

Use this information to answer the following questions.

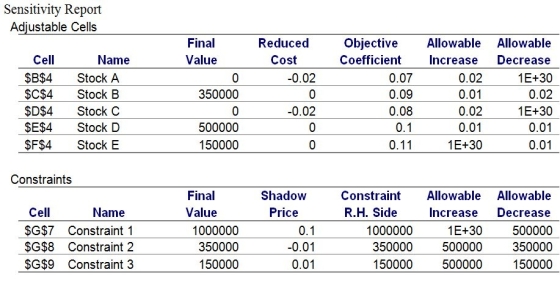

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.What would be the impact on the optimal allocation if the expected interest earned on stock A decreases to 6%?

b.What would be the impact on the optimal allocation if the expected interest earned on stock A increases to 10%?

c.What should the minimal expected interest earned for stock C be before it would be desirable to invest in this particular stock?

d.What would be the impact on the optimal allocation and the objective function value if the expected interest earned on stock B decreases by 1%?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Use this information to answer the

Q2: Use this information to answer the

Q4: The slack of a constraint indicates the

Q5: Use this information,along with its associated

Q6: Surplus is typically associated with "≤" constraints.

Q7: Use this information,along with its associated

Q8: Use the information below to answer the

Q9: In pricing out a new variable,the worth

Q10: The Reduced Cost may be viewed as

Q11: Sensitivity analysis is analogous to postoptimality analysis