Multiple Choice

Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

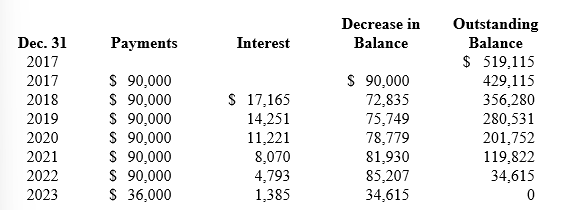

Reagan's lease amortization schedule appears below:

-In this situation, Reagan:

A) is the lessee in a sales-type lease.

B) is the lessee in a finance lease.

C) is the lessor in a finance lease.

D) is the lessor in a sales-type lease.

Correct Answer:

Verified

Correct Answer:

Verified

Q161: Leasehold improvements usually are classified in a

Q162: Which of the following statements characterizes an

Q163: Use the information below to answer the

Q164: Refer to the following lease amortization schedule.

Q165: Bird leased equipment that had a retail

Q167: When a company sells an asset and

Q168: Use the information below to answer the

Q169: What are the three types of expenses

Q170: Technoid Inc. sells computer systems. Technoid leases

Q171: What is selling profit in a sales-type