Multiple Choice

Use the information below to answer the following questions.

On December 31, 2017, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2023. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

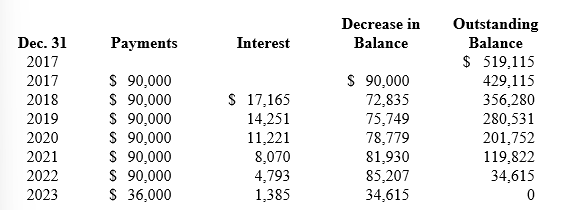

Reagan's lease amortization schedule appears below:

-What is the effective annual interest rate charged to Reagan on this lease?

A) 4%.

B) 6%.

C) 8%.

D) 17%.

Correct Answer:

Verified

Correct Answer:

Verified

Q252: Francisco leased equipment from Julio on December

Q253: On January 1, Smith Industries leased equipment

Q254: At the beginning of a finance lease,

Q255: To raise operating funds, Azure Sailing sold

Q256: Each of the four independent situations below

Q258: On January 1, 2018, Burrito Bill's leased

Q259: On June 30, 2018, Blue, Inc. leased

Q260: In a sale-leaseback arrangement, the lessee also

Q261: Discuss the three major types of leases

Q262: The five criteria provided in GAAP for