Multiple Choice

On January 1, 2018, Wellburn Corporation leased an asset from Tabitha Company. The asset originally cost Tabitha $300,000. The lease agreement is an operating lease that calls for four annual payments beginning on January 1, 2018, in the amount of $36,000. The other three remaining payments will be made on January 1 of each subsequent year. Which of the following journal entries should Tabitha record on January 1, 2018?

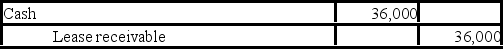

A)

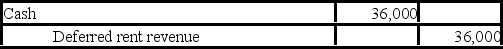

B)

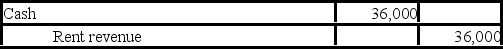

C)

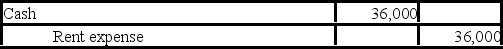

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q222: If the lessee and lessor use different

Q223: Sometimes a lease might specify that lease

Q224: Northwestern Edison Company leased equipment from

Q225: On January 1, 2018, Gemini Corporation leased

Q226: Franconia Leasing leases equipment to a variety

Q228: On January 1, 2018, Park Industrial leased

Q229: Diablo Company leased a machine from Juniper

Q230: Refer to the following lease amortization schedule.

Q231: N Corp. entered into a nine-year finance

Q232: Advance payments made by the lessee on