Multiple Choice

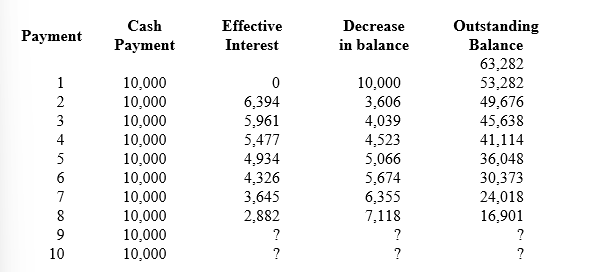

Refer to the following lease amortization schedule. The 10 payments are made annually starting with the beginning of the lease. Title does not transfer to the lessee and there is no purchase option or guaranteed residual value. The asset has an expected economic life of 12 years. The lease is noncancelable.

-What amount would the lessee record as annual amortization on the right-of-use asset using the straight-line method?

A) $5,328.

B) $6,328.

C) $6,392.

D) $10,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q191: The discount rate influences virtually every amount

Q192: Durney Co. recorded a right-of-use asset of

Q193: In an eight-year finance lease, the portion

Q194: On a transaction that qualifies for sale-leaseback

Q195: Distinguishing between operating and finance leases is

Q197: Describe the use of amortization for an

Q198: Refer to the following lease amortization schedule.

Q199: Which of the following is not among

Q200: Charles River Hospital leased medical equipment from

Q201: Refer to the following lease amortization schedule.