Multiple Choice

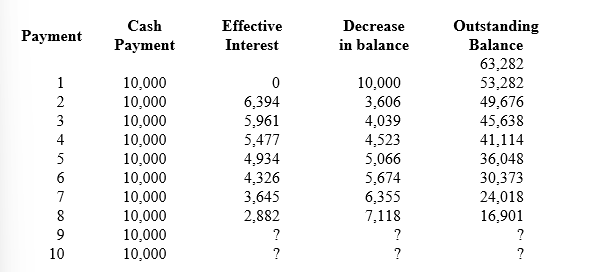

Refer to the following lease amortization schedule. The 10 payments are made annually starting with the beginning of the lease. Title does not transfer to the lessee and there is no purchase option or guaranteed residual value. The asset has an expected economic life of 12 years. The lease is noncancelable.

-If the lessor retains title to leased property under the terms of the lease:

A) The amount to be recovered through periodic lease payments is reduced by the present value of any residual amount.

B) The amount to be recovered through periodic lease payments is increased by the present value of the residual amount.

C) The amount to be recovered will be the same as if there were no residual value.

D) The lessor will record a greater amount of depreciation due to the residual value.

Correct Answer:

Verified

Correct Answer:

Verified

Q176: What situations cause a lessee to remeasure

Q177: The Bobo Company leased equipment from Bolinger

Q178: Differentiate between guaranteed and unguaranteed residual value

Q179: The costs that (a) are associated directly

Q180: Rumsfeld Corporation leased a machine on

Q182: On January 1, 2018, Tennessee Valley Corporation

Q183: On October 1, 2018, Sonoma Company leased

Q184: From the perspective of the lessor, two

Q185: On January 1, Sepe Vineyard Supply leased

Q186: Is it possible that a finance lease