Essay

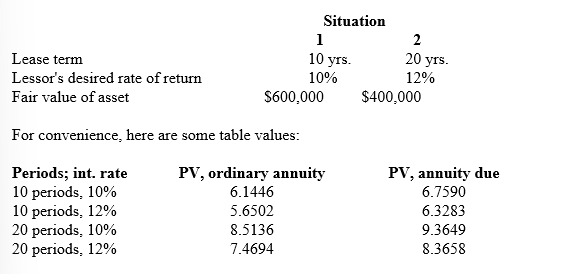

Each of the two independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit interest rate.

Required: For each situation determine the amount recorded as a liability by the lessee at the beginning of the lease. Round your answers to the nearest whole dollar amounts.

Correct Answer:

Verified

Using the implicit rate the lessor deter...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q147: Brady Leasing leases mechanical equipment to industrial

Q148: Gamma Leasing acquires equipment and leases it

Q149: Courage Enterprises leased equipment from Sixth Street

Q150: On December 31, 2018, Bedford Corp. sold

Q151: In a ten-year finance lease agreement, the

Q153: By the lessor, a lessee-guaranteed residual value

Q154: Barr Corp. is the lessee in a

Q155: If the leaseback portion of a sale-leaseback

Q156: Refer to the following lease amortization schedule.

Q157: When a finance lease is first recorded