Multiple Choice

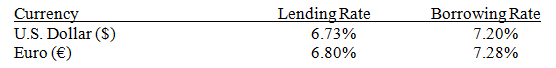

Assume the following information regarding U.S.and European annualized interest rates:

Milly Bank can borrow either $20 million or €20 million.The current spot rate of the euro is $1.13.Furthermore,Milly Bank expects the spot rate of the euro to be $1.10 in 90 days.What is Milly Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days

A) $579,845.

B) $583,800.

C) $588,200.

D) $584,245.

E) $980,245.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Any event that increases the U.S.demand for

Q14: If the U.S.and Japan engage in much

Q22: An increase in U.S. interest rates relative

Q24: A large increase in the income level

Q26: The real interest rate adjusts the nominal

Q29: The value of the Australian dollar (A$)

Q31: In general, when speculating on exchange rate

Q52: The markets that have a smaller amount

Q57: Trade-related foreign exchange transactions are more responsive

Q62: Assume that the U.S. experiences a significant