Multiple Choice

The following regression model was estimated by Delta Corporation to forecast the value of the Indian rupee (INR) :

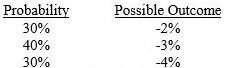

where INR is the quarterly change in the rupee, is the real interest rate differential in period between the U.S. and India, and is the inflation rate differential between the U.S. and India in the previous period. Regression results indicate coefficients of ; and . Assume that . However, the interest rate differential is not known at the beginning of period and must be estimated. Delta Corp. has developed the following probability distribution:

The expected change in the Indian rupee in period is:

A) 3.40%.

B) 0.40%.

C) 3.10%.

D) 1.70%.

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q2: If foreign exchange markets are strong-form efficient,

Q3: Fundamental models examine moving averages over time

Q9: Which of the following is true according

Q14: Which of the following is true<br>A) Nominal

Q17: Sulsa Inc.uses fundamental forecasting.Using regression analysis,it

Q19: According to the text,research supports _ in

Q25: A regression analysis of the Australian dollar

Q31: MNCs can forecast exchange rate volatility to

Q82: Assume that the forward rate is used

Q86: The closer graphical points are to the