Multiple Choice

The following regression model was run by a U.S.-based MNC to determine its degree of economic exposure as it relates to the Australian dollar and Sudanese dinar (SDD) :

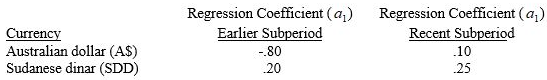

where the term on the left-hand side is the percentage change in inflation-adjusted cash flows measured in the firm's home currency over period , and is the percentage change in the exchange rate of the currency over period . The regression was run over two subperiods for each of the two currencies, with the following results:

Based on these results,which of the following statements is probably not true?

A) The MNC was more sensitive to movements in the Australian dollar than in the dinar in the earlier subperiod.

B) The MNC was more sensitive to movements in the dinar than in the Australian dollar in the more recent subperiod.

C) The MNC probably had more outflows than inflows in Australian dollars in the earlier subperiod.

D) The MNC probably had more inflows than outflows denominated in dinar in the more recent subperiod.

E) All of the above are true.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Cerra Co.expects to receive 5 million euros

Q18: Transaction exposure reflects:<br>A) the exposure of a

Q20: Jacko Co.is a U.S.based MNC with net

Q23: If a U.S. firm's cost of goods

Q27: Diz Co. is a U.S.-based MNC with

Q44: Dubas Co. is a U.S.-based MNC that

Q47: The Canadian dollar consistently appears to move

Q52: The exposure of an MNC's consolidated financial

Q62: Subsidiary A of Mega Corporation has net

Q68: If an MNC expects cash inflows of