Multiple Choice

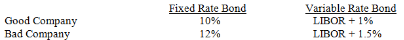

Good Company prefers variable to fixed rate debt.Bad Company prefers fixed to variable rate debt.Assume the following information for Good and Bad Companies:

Given this information:

A) an interest rate swap will probably not be advantageous to Good Company because it can issue both fixed and variable debt at more attractive rates than Bad Company.

B) an interest rate swap attractive to both parties could result if Good Company agreed to provide Bad Company with variable rate payments at LIBOR + 1% in exchange for fixed rate payments of 10.5%.

C) an interest rate swap attractive to both parties could result if Bad Company agreed to provide Good Company with variable rate payments at LIBOR + 1% in exchange for fixed rate payments of 10.5%.

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Countries where bond yields are _ tend

Q6: A U.S.firm has a Canadian subsidiary that

Q7: In a(an)_ swap,two parties agree to exchange

Q8: A floating coupon rate can be an

Q9: Two limitations of interest rate swaps are

Q10: Minnie Corp.has decided to issue three-year bonds

Q11: Some firms may be uncomfortable issuing bonds

Q14: An MNC issuing pound-denominated bonds may be

Q41: Simulation is useful in the bond-denomination decision

Q47: If the foreign currency that was borrowed