Multiple Choice

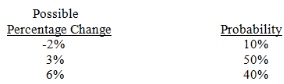

A firm forecasts the euro's value as follows for the next year:

The annual interest rate on euro is 7%. The expected value of the effective financing rate from a U.S.firm's perspective is about:

A) 8.436%.

B) 10.959%.

C) 11.112%.

D) 11.541%.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: If interest rate parity exists and transactions

Q14: Assume that interest rate parity exists, and

Q15: Maston Corporation has forecasted the value of

Q18: What is the probability that the financing

Q19: The effective financing rate:<br>A) adjusts the nominal

Q20: Assume that the U.S.interest rate is 11%

Q21: What is the expected effective financing rate

Q28: Assume that interest rates of most industrialized

Q30: Countries with a _ rate of inflation

Q37: When a U.S. firm borrows a foreign