Multiple Choice

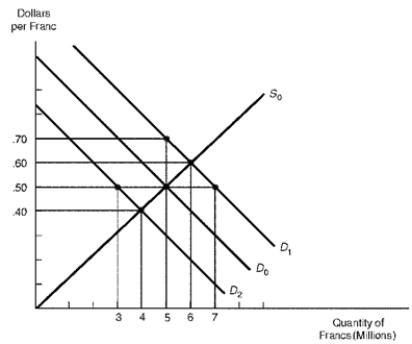

Figure 15.1 shows the market for the Swiss franc.In the figure,the initial demand for marks and supply of marks are depicted by D0 and S0 respectively.

Figure 15.1.The Market for the Swiss Franc

-Refer to Figure 15.1.Suppose the United States decreases investment spending in Switzerland,thus reducing the demand for francs from D0 to D2.Under a floating exchange rate system,the new equilibrium exchange rate would be:

A) $0.40 per franc

B) $0.50 per franc

C) $0.60 per franc

D) $0.70 per franc

Correct Answer:

Verified

Correct Answer:

Verified

Q52: Figure 15.2 Market for the British Pound

Q65: Figure 15.1 shows the market for the

Q69: Which nations use multiple exchange rates the

Q90: A potential disadvantage of freely floating exchange

Q102: By the early 1970s, gold had been

Q105: To offset an appreciation in the dollar's

Q107: Which exchange-rate mechanism is intended to insulate

Q126: The par values of most developing-country currencies

Q143: If Mexico dollarizes its economy,it essentially<br>A) Allows

Q168: Under a system of floating exchange rates,a