Multiple Choice

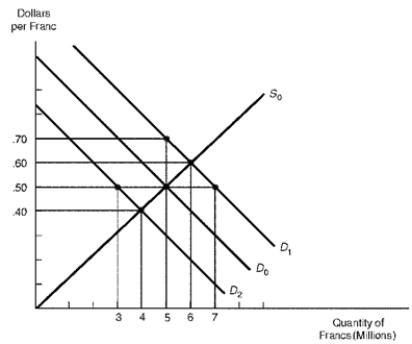

Figure 15.1 shows the market for the Swiss franc.In the figure,the initial demand for marks and supply of marks are depicted by D0 and S0 respectively.

Figure 15.1.The Market for the Swiss Franc

-Refer to Figure 15.1.Suppose the demand for francs increases from D0 to D1.Under a fixed exchange rate system,the U.S.exchange stabilization fund could maintain a fixed exchange rate of $0.50 per franc by:

A) Selling francs for dollars on the foreign exchange market

B) Selling dollars for francs on the foreign exchange market

C) Decreasing U.S.exports,thus decreasing the supply of francs

D) Stimulating U.S.imports,thus increasing the demand for francs

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Pegging to a single currency is generally

Q13: Under managed floating exchange rates,the Federal Reserve

Q15: A "key currency" is one that is

Q45: What is an SDR?

Q47: Under a floating exchange-rate system,which of the

Q52: Under a floating exchange-rate system,if American exports

Q56: The Australian dollar is currently regarded is

Q91: To keep the pound's exchange value from

Q125: Given a two-country world,suppose Japan devalues the

Q149: Rather than constructing their own currency baskets,many