Essay

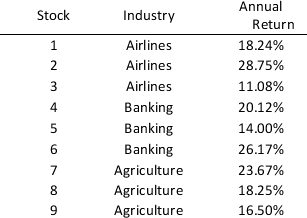

Andrew is ready to invest $200,000 in stocks and he has been provided nine different alternatives by his financial consultant. The following stocks belong to three different industrial sectors and each sector has three varieties of stocks each with different expected rate of return. The average rate of return taken for the past ten years is provided with each of the nine stocks.

The decision will be based on the constraints provided below:

-Exactly 5 alternatives should be chosen.

-One stock can have a maximum invest of $55,000.

-Any stock chosen must have a minimum investment of at least $25,000.

-For the Airlines sector, the maximum number of stocks chosen should be two.

-The total amount invested in Banking must be at least as much as the amount invested in Agriculture.

Now, formulate a model that will decide Andrew's investment strategy to maximize his expected annual return.

Correct Answer:

Verified

Let X₁, X₂, X₃, X₄, X₅, X₆, X₇, X₈, and ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Reference - 9.1. The available size of

Q11: In binary integer linear program, the integer

Q11: The importance of _ for integer linear

Q12: Sansuit Investments is deciding on future investment

Q13: A manufacturer wants to construct warehouses in

Q15: The worksheet formulation for integer linear programs

Q16: The objective function for a linear optimization

Q18: Reference - 9.1. The part-worths for each

Q19: Reference - 9.1. Pink, green, and black

Q20: According to the _ constraint, the sum