Essay

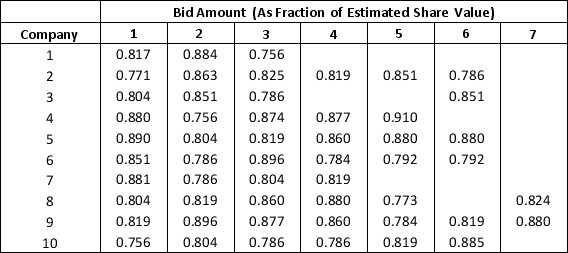

A specialty hedge fund is considering the purchase of a Jackson Pollock painting. It estimates the value of the painting to be $185 million. In an auction, both the number of competing bids and the amount of the competing bids is uncertain. The hedge fund has maintained a file summarizing 10 recent art auctions that it believes are similar to the upcoming auction. It is considering a bid of $163 million and would like to evaluate its chances of winning the upcoming auction with this bid.

a. Construct a spreadsheet simulation model to determine the likelihood of the hedge fund winning the auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts.

a. Construct a spreadsheet simulation model to determine the likelihood of the hedge fund winning the auction. Use a discrete uniform distribution between the minimum and maximum number of bidders in the 10 observed auctions to model the number of bidders in the Jackson Pollock auction. Fit a realistic distribution to the bid data to generate values of competing bid amounts.

b. For a bid amount of $163 million, estimate the probability of the hedge fund winning the auction?

Correct Answer:

Verified

a. Refer to the screenshot bel...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: According to the _, the sum of

Q3: In Excel, the expression LN(RAND())*(-m) would generate

Q6: An input to a simulation model that

Q27: Sunseel Industries produces different types of raw

Q31: Salemach Corporation is a start-up company that

Q32: ASP cannot guarantee an optimal solution to

Q33: The stock price of Robin Tires, Inc.,

Q34: A(n) _ is an input to a

Q35: The values for random variables in a

Q40: The process of evaluating a decision in