Essay

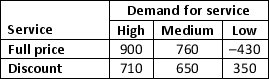

Meega airlines decided to offer direct service from Akron to Clearwater beach, Florida. Management must decide between full-price service using a company's new fleet of jet aircraft and a discount-service using smaller capacity commuter planes. Management developed estimates of the contribution to profit for each type of service based upon two possible levels of demand for service on Clearwater beach: high, moderate, and low. The following table shows the estimated quarterly profits (in thousands of dollars):

a. If the demand probabilities are 0.3, 0.5, and 0.2, what is the best decision using the expected value approach?

b. Construct a risk profile for the optimal decision in part a. What is the probability of the profit exceeding $700,000?

Correct Answer:

Verified

a. EV(Full) = 0.3(900) + 0.5(760) + 0.2(...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A(n) _ refers to the result obtained

Q3: The minimax regret approach is<br>A)purely optimistic.<br>B)purely conservative.<br>C)both

Q6: The utility function for money is a

Q11: _ is a measure of the total

Q27: A special case of sample information where

Q36: The study of how changes in the

Q41: Exponential utility functions indicate that the decision

Q45: Consider an advertising company which has to

Q51: Emil Hansen is interested in leasing a

Q53: Reference - 12.1: Use the payoff table