Essay

The Golden Jill Mining Company is interested in procuring 10,000 acres of coal mines in Powder River Basin. The mining company is considering two payment-plan options to buy the mines:

I. 100% Payment

II. Installment-Payment

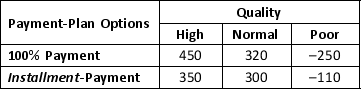

The payoff received will be based on the quality of coal obtained from the mines which has been categorized as High, Normal, and Poor Quality as well as the payment plan. The profit payoff in million dollars resulting from the various combinations of options and quality are provided below:

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

b. If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches?

Correct Answer:

Verified

a. The decision to be made is to choose ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Translate the following monetary payoffs into utilities

Q19: _ refers to the probability of one

Q21: Reference - 12.2: Use the data below

Q22: The probabilities of both sample information and

Q23: Reference - 12.2: Use the data below

Q24: Three decision makers have assessed payoffs for

Q24: The amount of loss (lower profit or

Q27: Emil Hansen is interested in leasing a

Q29: Reference - 12.1: Use the payoff table

Q30: _ refer to graphical representations of the