Essay

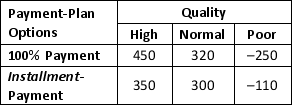

The Golden Jill Mining Company is interested in procuring 10,000 acres of coal mines in Powder River Basin. The mining company is considering two payment-plan options to buy the mines:

I. 100% Payment

II. Installment-Payment

The payoff received will be based on the quality of coal obtained from the mines which has been categorized as High, Normal, and Poor Quality as well as the payment plan. The profit payoff in million dollars resulting from the various combinations of options and quality are provided below:

a. Suppose that management believes that the probability of obtaining High Quality coal is 0.55, probability of Normal Quality Coal is 0.35, and probability of Poor Quality Coal is 0.1. Use the expected value approach to determine an optimal decision.

a. Suppose that management believes that the probability of obtaining High Quality coal is 0.55, probability of Normal Quality Coal is 0.35, and probability of Poor Quality Coal is 0.1. Use the expected value approach to determine an optimal decision.

b. Suppose that management believes that the probability of High Quality coal is 0.25, probability of Normal Quality Coal is 0.4, and probability of Poor Quality Coal is 0.35. What is the optimal decision using the expected value approach?

Correct Answer:

Verified

a. EV(100% Payment) = 0.55(450) + 0.35(3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: What would be the value added by

Q21: Which of the following is true of

Q31: _ refer to the probabilities of the

Q32: An uncertain future event affecting the consequence

Q37: A manufacturing company introduces two product alternatives.

Q39: The _ approach evaluates each decision alternative

Q40: For a maximization problem, the optimistic approach

Q41: Exponential utility functions indicate that the decision

Q43: Three decision makers have assessed payoffs for

Q45: Consider an advertising company which has to