Multiple Choice

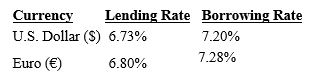

Assume the following information regarding U.S. and European annualized interest rates:

Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

A) $579,845.

B) $583,800.

C) $588,200.

D) $584,245.

E) $980,245.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The supply curve for a currency is

Q11: Any event that reduces the supply of

Q18: Relatively high Japanese inflation may result in

Q23: Illiquid currencies tend to exhibit _ volatile

Q26: The real interest rate adjusts the nominal

Q31: In general, when speculating on exchange rate

Q39: Increases in relative income in one country

Q50: If a country experiences high inflation relative

Q55: Assume that the British government eliminates all

Q63: Assume that the inflation rate becomes much